The United States government has taken a major step into the semiconductor industry by purchasing a ten percent stake in Intel. The deal, valued at $8.9 billion, was announced late Friday.

Intel will receive $5.7 billion in grants that were promised under the CHIPS and Science Act but had not yet been paid. Another $3.2 billion comes through the Secure Enclave program.

The Secure Enclave program is intended to fund development of specialized secure chips for military and government use. Combined with earlier payments, Intel now holds more than $11 billion in federal support.

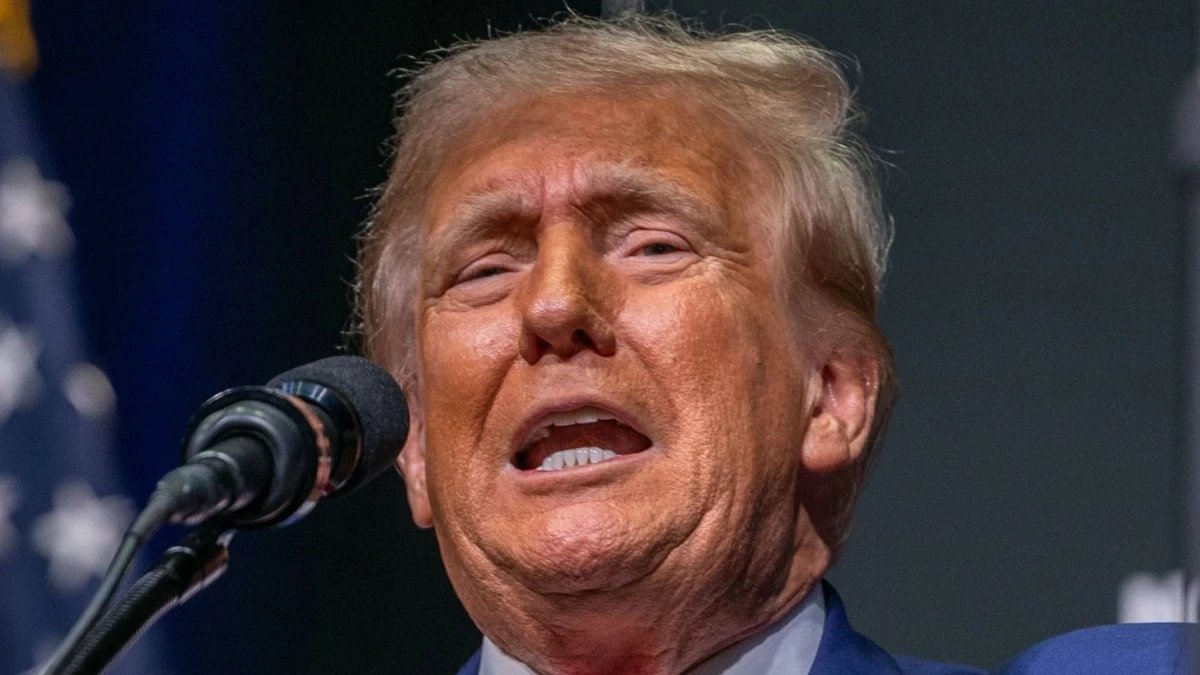

President Donald Trump announced the move on his Truth Social account. He described the investment as “a Great Deal for America and a Great Deal for Intel.”

“It is my Great Honor to report that the United States now owns and controls ten percent of Intel,” Trump said. He claimed the government paid nothing for the shares.

Intel’s stock closed more than five percent higher on Friday, giving the company a market capitalization near $110 billion. That values the government’s stake at roughly $11 billion.

Although Trump said the government paid nothing, the shares were bought with funds already set aside by earlier programs. No additional money was spent beyond prior allocations.

Intel has struggled to regain leadership in chip design and manufacturing. Competitors like Taiwan Semiconductor Manufacturing Company (TSMC) have taken the lead in advanced logic chips. Intel is seeking to reverse that trend.

The new money is expected to help Intel rebuild advanced manufacturing facilities in the United States. This supports a wider White House effort to reduce reliance on Asian suppliers.

Lip-Bu Tan, Intel’s chief executive since March, praised the agreement. “As the only semiconductor company that does leading-edge logic research and manufacturing in the U.S., Intel is deeply committed to American-made technology,” he said.

Tan added that Trump’s support for U.S. chipmaking was bringing historic investments. “We are grateful for the confidence placed in Intel, and we look forward to working together,” he said.

The announcement comes after a rocky start for Tan. Earlier this month, Trump called for his resignation, saying he was “highly conflicted.” The tone has now changed after recent White House talks.

Under the agreement, the government also has an option to buy another five percent of Intel shares at $20 each. The market price is about $25, making the option valuable.

Officials confirmed that the United States will not have a seat on Intel’s board. However, they reserved rights to intervene only under “limited exceptions.” Management will remain in control.

Howard Lutnick, Secretary of Commerce, welcomed the deal. “Intel is excited to welcome the United States of America as a shareholder,” he said. He added that this would help reinforce U.S. strength in artificial intelligence.

Rumors about government investment in Intel have circulated for months. Many analysts had criticized giving Intel cash with no returns. A share purchase, they argue, is a better outcome for taxpayers.

For decades, Intel spent tens of billions on stock buybacks while falling behind rivals in technology. The deal ensures taxpayers receive value, while also supporting a strategic national industry.

Intel’s position in the global market has weakened in recent years. Companies in Taiwan and South Korea now dominate advanced chips, creating supply risks for American industries and the military.

The U.S. government has been seeking to reduce that risk. Lawmakers passed the CHIPS Act to promote domestic production, and the Intel deal is the largest direct stake so far.

The White House says this will secure supply chains for critical sectors like defense and artificial intelligence. The move is also expected to attract more private investment in U.S. manufacturing.

The government is now both a regulator and an investor in Intel. Some experts see that as unusual, but many note it gives Washington a stronger hand in steering future technology policy.

Supporters call it a smart bet. Intel gains money to rebuild factories and research. Taxpayers gain a valuable asset. America gains more secure access to a vital technology.

[inline_related_posts title=”RECOMMENDED” title_align=”left” style=”list” number=”2″ align=”none” ids=”” by=”primary_cat” orderby=”rand” order=”DESC” hide_thumb=”no” thumb_right=”no” views=”no” date=”yes” grid_columns=”2″ post_type=”” tax=””]

The stock market appears to agree. Investors reacted positively on Friday, pushing Intel’s share price higher. Analysts expect more government support for the sector in coming months.

While challenges remain, the deal marks a turning point. The United States now holds a direct stake in its largest domestic chipmaker, sending a signal about the importance of keeping production at home.